South carolina s tax credits may be earned by individuals c corporations s corporations partnerships sole proprietors and limited liability companies.

South carolina solar tax credit expiration.

Your income tax for 2018 will be 3 271 and half of that is 1 636.

Cut the cost of installing solar on your home by a quarter with south carolina s state tax credit for solar energy.

25 of total system cost up to 35 000.

Federal energy efficiency tax.

Residents of the palmetto state can claim 25 percent of their solar costs as a tax credit and if you don t pay enough in taxes to get the full value of the credit in one year it.

With so many.

Can only take 3 500 or 50 of your tax liability per year for up to 10 years.

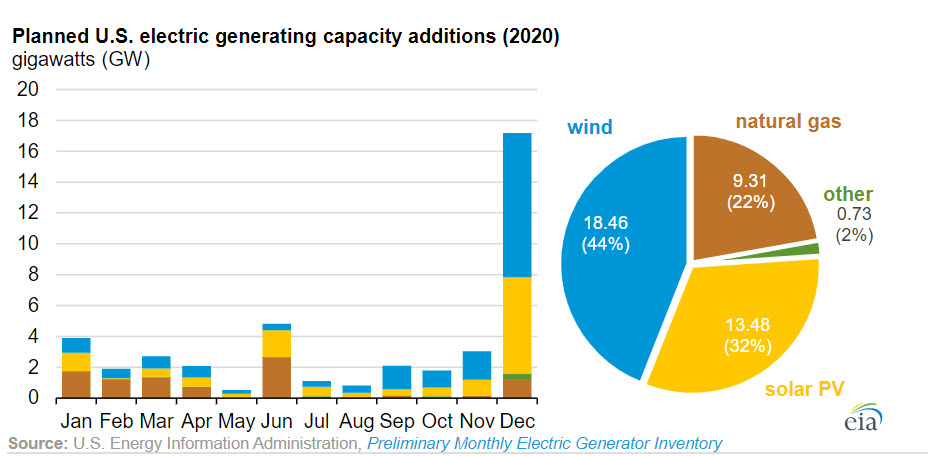

When you consider the recent extension of the federal itc for solar the horizon of incentives in north carolina broadens even further.

Solar panels allow you to generate clean energy and can save you money.

The corresponding code.

Federal investment tax credit.

The state of south carolina offers a number of tax incentives for energy efficiency and fuel production.

South carolina s solar energy tax credit passed by the state legislature lets residents claim a state tax credit of 25 of the whole installed cost of a solar pv system.

A tax credit is an amount of money that can be used to offset your tax liability.

Say you re a married couple making 75 000 yr.

South carolina solar energy tax credit.

Credits are usually used to offset corporate income tax or individual income tax.

General tax credit questions.

The state of south carolina offers an additional tax credit for home and business owners who go solar worth 25 of the total cost including installation.

The energy office works in cooperation with the sc department of revenue to coordinate the application of these incentives.

The largest credit that can be applied in a single year is 3500 or 50 of your state tax liability whichever is less.

Your 5 kw solar system costs 16 250 meaning you re eligible for a state tax credit of 4 063 25 of the cost.

However purchasing a solar system or signing a 20 year lease for solar panels is like buying a car you need to do your homework check prices from several sources and think carefully about.

Solar sc gov is south carolina s source for solar information.

Here s an example of how the south carolina tax credit works.

Credits not used may be carried forward for ten years.

For a list of incentives by category visit the south carolina tax incentives webpage.

Taxcredits dor sc gov angel investor credit parental refundable credit and education donor nonrefundable credit.

25 south carolina tax credit for solar energy systems.

.png)