Click submit review your details and click confirm enter the one time password sent to your registered mobile number and tap submit code how to cash in to paymaya wallet.

Security bank mobile app to gcash.

Please note that there is a monthly cash limit of p50 000 per mobile number.

Can i send egivecash to myself.

Cash in via bpi to gcash bpi mobile app cash in via aub to gcash.

Click transfer then select other banks and select your source account.

Free gcash cash in via security bank with new mobile app feature adding money from your security bank to gcash is easy and free of charge.

The receiver may now go to the nearest security bank atm with egivecash to pick up the cash.

View partner list here.

This is only available at security bank atms with egivecash enabled.

How much can i send through egivecash.

Through security bank mobile app.

Via linked bank account in the gcash app bpi and unionbank free.

You can send from p500 up to p10 000 per transaction in denomination of p100.

Notify the receiver that you are done.

Log in to your security bank mobile app make sure that your app is updated.

Security bank is offering free instapay transfers until further notice.

Then choose your preferred bank from the list.

Security bank mobile provides a number of security measures to protect the confidentiality of your accounts when banking on your ios smart phones which includes the following.

For the full list of atms with egc click here.

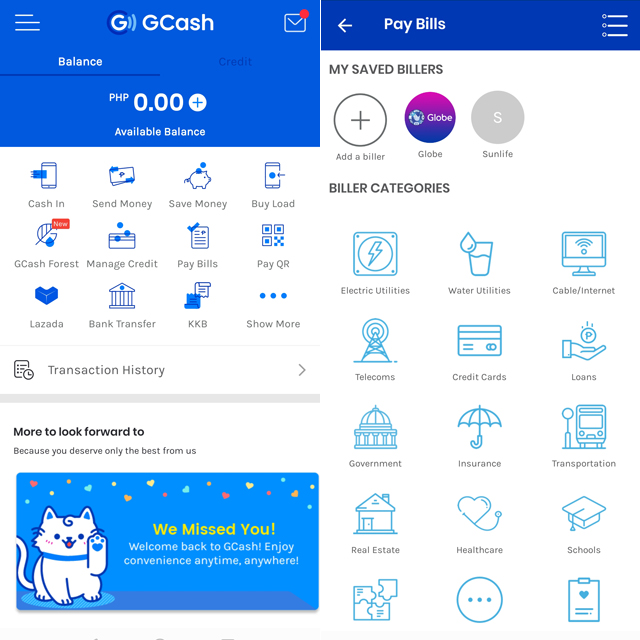

Cash in via bank emi apps cash in to your gcash account using your bank s app website via instapay.

View fee breakdowns here.

Fees depend on bank partners.

Please note that there is a monthly cash limit of p50 000 per mobile number.

Click bank cards on my linked accounts.

Banks instapay service remain free until further notice.

Fill in the details.

The coronavirus pandemic made us more reliant on digital banking and cashless transactions.

Click bank cards on my linked accounts.

Enter your desired amount and select your security bank card you wish to deduct the reload from.

You can send from p500 up to p10 000 per transaction in denomination of p100.

To view the list of available banks on the gcash app tap on bank transfer on the dashboard.

What are the security features of security bank mobile app.

Click submit review your details and click confirm enter the one time password sent to your registered mobile number and tap submit code.

Via bank s mobile banking app.

The bank transfer feature allows you to transfer funds from your gcash wallet to your selected bank accounts without the hassle of lining up for hours.

Enter your desired amount and select your security bank card you wish to deduct the reload from.

Via over the counter outlets will have a fee once users exceed the monthly free limit of php8 000.

Click on your preferred bank below to view instructions on how to cash in and to stay up to date with the latest rates.